| Sr | Card Approach | Aadhaar + OTP |

|---|---|---|

| 1 | User chooses option to set UPI Pin using Debit Card Details. | User chooses to use Aadhaar OTP authentication. |

| 2 | User enters debit card details to set UPI Pin. | User enters the Aadhaar details and authenticate. |

| 3 | User enters the OTP from Bank. | User enters OTP from Bank as well as OTP from UIDAI. |

| 4 | User sets New UPI Pin. | User sets New UPI Pin. |

Yes, the customer will be able to choose Aadhaar OTP for UPI PIN SET/RESET even though there is a debit card associated with the account provided the customer’s bank is supporting Aadhaar OTP functionality.

For any UPI transaction it is mandatory to enter UPI PIN to authorize transaction. SET UPI PIN is the option to set the UPI PIN using customer Debit card /Aadhaar otp.

Yes, UPI services can be availed using Aadhaar OTP service.

Customer can set UPI PIN by using Aadhaar OTP platform validating his first 6 digits of Aadhaar number and entering Aadhaar OTP & Issuer OTP.

No, it is not a mandatory option to set UPI Pin using Aadhaar OTP the choice is with the customer to select between Debit card and Aadhaar.

No, Customer is not required to pay any charges for setting UPI Pin.

Customer will have the option to set UPI PIN using Aadhaar along with the Debit Card option.

Yes, both the Aadhaar linked mobile number & Bank account linked mobile number should be same.

Yes, the mobile number gets validated at both UIDAI & Issuer (Customers Bank account linked Bank) Bank’s end.

If customer has different mobile numbers linked to Aadhaar and bank account the request would get terminated.

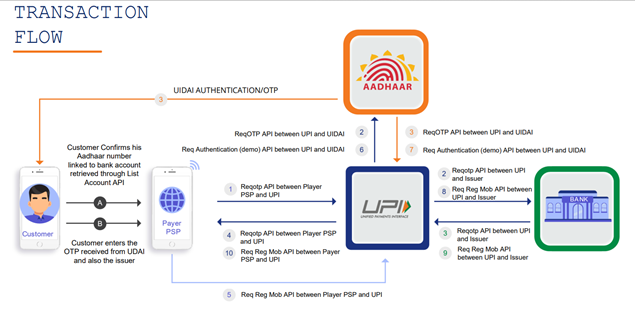

For setting the UPI PIN through Aadhaar, the customer will receive two OTPs: one from UIDAI and the other from the issuer bank.

Yes, customer can use Aadhaar OTP option to reset UPI Pin.

Yes, Customer can use Aadhaar OTP if customers debit card gets hot listed.

Customer consent is required to be taken as the Aadhaar number of the customer is being fetched and validated for setting UPI Pin Customer consent has to be taken for every set UPI PIN using Aadhaar.

No, customers Aadhaar number is being used only for authentication purpose for setting UPI Pin and will be deleted once session is completed.

Yes, it is customer’s choice to opt from debit card and Aadhaar card.

Customer can opt to reset UPI PIN through Debit card instead of Aadhaar there is no revoke consent option.

The transaction would get terminated once the same is validated at Req Auth (demo at UIDAI).

aeba flag from Issuer end should be passed as N and customer would be communicated about the same.

Only after success response from UIDAI, UPI would fire Req OTP to Issuer.

Yes CL 1.7

No, in Phase 2

Yes, Bank has to pay to UIDAI for yes/no authentication .

No, as of now only Smart phone users have the functionality to set pin using Aadhaar.

License key and AUA code are provided by UIDAI to entities who are AUA with UIDAI .Bank as an AUA should share/pass LK& AUA in the request to UPI and same would be carry forwarded for UIDAI authentication.

Bank has below three scope for Aadhaar

Final test cases shared with bank

Bank can use CZ tool for running defined scope of test cases.

Yes, App testing will be required for UI/UX change.

Standard checklist applicable, already shared with banks.

Applicable: UAT testing + CUG testing (APP sec and IS approval as per scope).