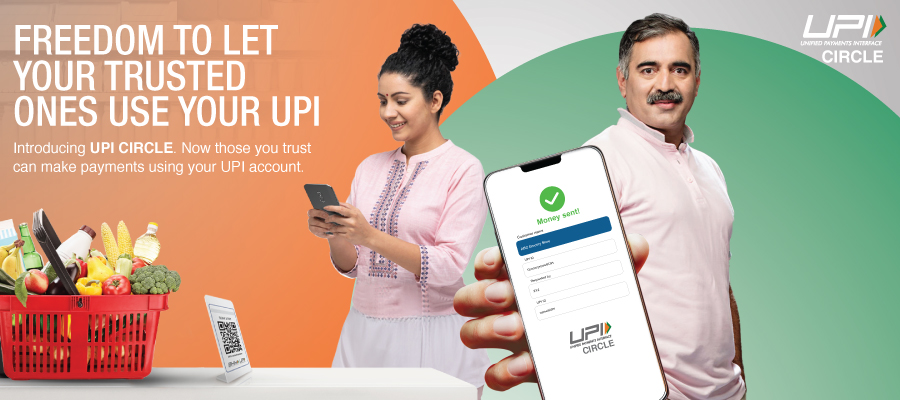

UPI Circle is a solution where a payer can extend the authorization to transact from their UPI account to an individual with required limits. It enables a secondary user to perform transactions from the payer’s account with minimum intervention and with adequate risk mitigations.

Primary User - An UPI user who is delegating the UPI authentication to make payment to a secondary user

Secondary User - An UPI user who will be performing UPI payments with appropriate authorization of the primary user. A secondary user is an individual with or without having a bank account linked on UPI.

In the current payment ecosystem, cash as a payment instrument is still being used predominantly. UPI has created a seamless digital experience to enable users to transact via their mobile devices, however there is still the pre-requisite for a user to have a bank account to transact through UPI. Currently users are still dependent on cash for their daily payment needs because they do not manage their own money through their own account.

Also, control resides with primary user to make UPI transactions on behalf of their secondary users because they have a bank account and manage finances of a household. About 6% of UPI users make large number of transactions mainly because they also make transactions on behalf of others. This feature will allow primary user to have the same control while offering more convenience while making delegated payments.

A payment solution for these types of users who do not use UPI due to lack of enablement or wariness of digital payments is now solutioned with UPI Circle feature.

Parent providing expenses to his college kid…

As a Parent of a junior college going student who might need to spend money on stationary, travel, food etc. I want to give my child the ability to spend money using cash-free methods, but I also want to monitor my child’s expenses so that I’m assured that my child is spending only on the required things and not anywhere else and without risk of holding the cash.

Senior citizen who is wary of digital payments…

As a senior citizen who goes out to buy daily necessities, I’m unsure to carry out online transactions on my own. I want my children to pay and enter the necessary details to proceed with the transaction so that I can shop freely and don’t have to go through the stress of online payment wherever I go.

Busy individual who wants to delegate household expenses…

As a corporate employee, whose spouse is also working 9-5, but we don’t have enough time and energy left after work to buy household items on our own. I want my maid to do the shopping and pay on my behalf but within an authorization limit, so that I can get all the necessary items fresh and on time while also managing my budget and not having to monitor each small transaction.

Business Owner who doesn’t want to give petty cash to their staff…

As a car rental service owner, where passenger transfers the one-time rental amount to my account, I want the drivers to do car petrol payments and pay for their own expenses online while on work so that it reduces the burden to handle the cash, and it is easier for me to control usage and track payments.