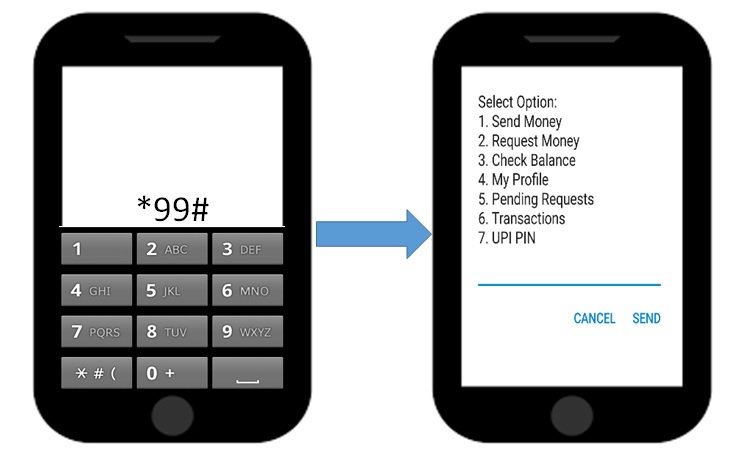

Services available are as follows:

Send Money – Using this option, customer can send money to any customer using various options provided.

Request Money – Using this option, customer can collect money by entering UPI ID or Mobile No. of a UPI registered customer.

Check Balance – Using this option, customer can check his/her account balance.

My Profile – Using this option, customer can perform transactions such as knowing his/her UPI details, changing language, managing UPI ID’s and beneficiaries.

Pending Transaction – Using this option, customer can check pending UPI requests (if any).

Transaction – Using this option, customer can know about the last 5 transactions performed on UPI.

UPI PIN – Using this option, customer can set/change his/her UPI PIN.

Yes, Customer should have mobile number with his/her bank system for using *99#.

The list of Banks and TSPs offering *99# service is available under the link https://www.npci.org.in/99-live-members on NPCI website.

In case of mobile loss, one needs to simply block his mobile number thus no transaction can be initiated from the same mobile number which is a part of device tracking and at the same time UPI Pin would be required for any transaction which is not to be shared with anyone.

Fund transfer request can be initiated 24*7 (round the clock) using the *99# service including on holidays. Similarly, funds remitted using the *99# service can be received by the beneficiary 24*7 (round the clock).

The service works across all GSM service providers and handsets. The service is currently not available for CDMA phones.

While doing transactions on *99#, customers may face following issues:

Handset Compatibility Issue: Though USSD based transactions works across all GSM handsets; however, owning to various reasons, sometimes few handsets do not support USSD service. Though, the numbers of such handset models is few; still users are requested to check if there handset supports the USSD service (in case they are facing problems while performing transaction).

Technical Error or Declined Request: Transaction not getting completed due to network/connectivity issues at TSPs or Banks end.

Wrong User Inputs: Transaction will get declined if the user enters wrong information like IFS Code, Account number, MPIN etc.

New *99# is providing additional benefits to users in the following ways:

NO this service can be availed on any type of phone.

Yes, *99# is currently available in Hindi & English (is available in all major 12 languages) you can select a default language on the 1st time registration on *99#. Language can also be changed from the option provided in the menu screen.

Nil

Yes, a customer needs to create a UPI Pin by dialing *99# or using bank’s UPI App, BHIM App or any UPI app.

No, registration of Beneficiary is not required for transferring funds through *99# as the fund would be transferred on the basis of UPI ID/ Account+ IFSC / Mobile No.

Option to save beneficiary after successful transaction is provided to the user.

Customer needs to have a bank account and a debit card, this facility is not available on wallets.

Yes, one can use more than one UPI application and *99# on the same mobile and link both same as well as different accounts.

In case of UPI ID transaction, the beneficiary needs to have a UPI ID which can be generated by registering on *99#, BHIM APP or from any other Bank UPI APP, but in case of Account + IFSC or Aadhaar number, the beneficiary need not be registered for *99#, BHIM APP or from any other Bank UPI APP.

Yes, Post using *99# or BHIM a default UPI ID MobileNo@UPI will be generated. Which can be linked to the bank which is selected.

The different services offered for transferring funds using *99# are:

*99# works on UPI which provides real time reversals for technical declines and amount would be transferred back to the payer account immediately.

No, once the payment is initiated, it cannot be stopped.

You can also raise your grievance related to *99# on BHIM APP or on your issuing bank. You can also check status of your BHIM or *99# transactions on *99#.

At present, the upper limit on *99# is Rs. 5000 per transaction.

In case of change in bank on *99#, a person needs to re-register for the bank and the default UPI ID (MobileNo@UPI) will be mapped to corresponding account.

In case someone forgets the UPI Pin, he/she needs to re-generate new PIN from *99# / BHIM / Bank’s UPI APP.

In case of change in Mobile No. you have to provide your new mobile number to your bank to be linked with your corresponding account.

In case of change in Handset you will be still able to use *99# from your registered mobile no.

NO, *99# is available on selected telecom service providers.(Link: https://www.npci.org.in/what-we-do/99/live-members)

If a beneficiary has initiated a collect request transaction, Payer will be sent an SMS notifying him to dial *99# to accept / reject the requested money.

In any transaction through *99#, UPI Pin would be required which needs to be fed through the mobile at the time of any transaction making it safe and secured.

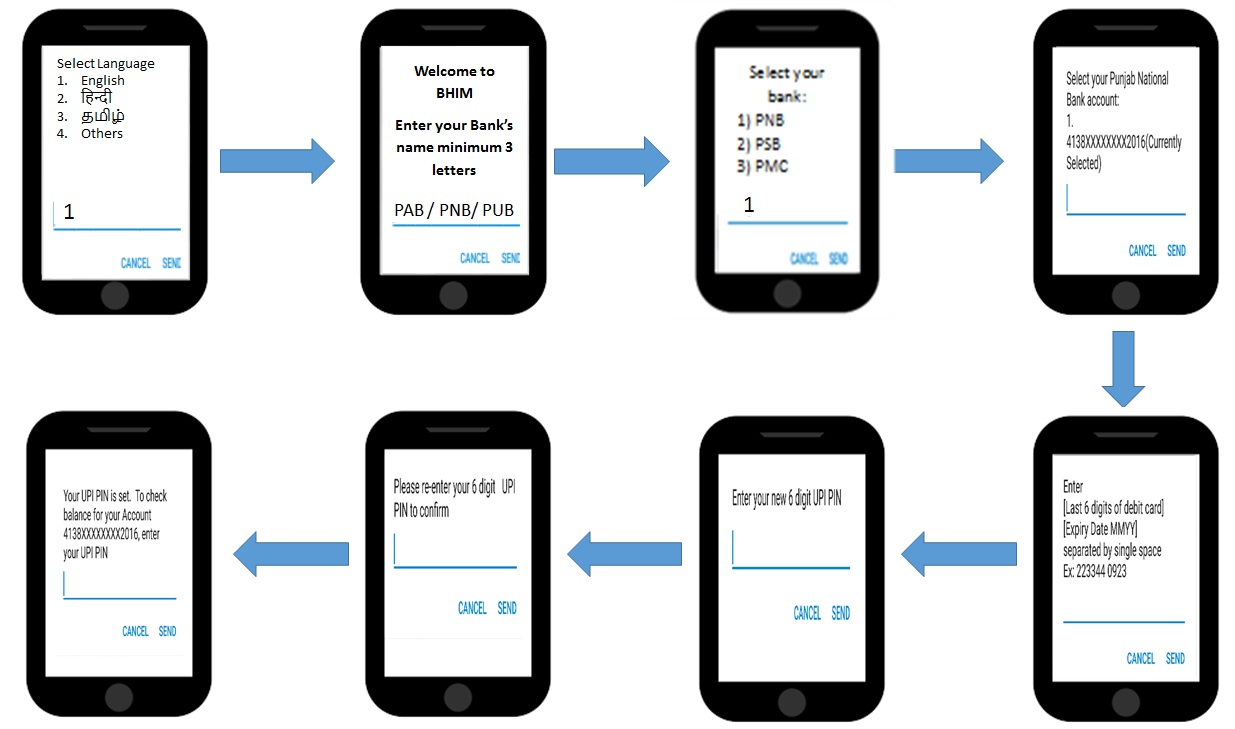

Following are the steps:

Onboarding Flow:

Regular User: