Product Overview:

RuPay Credit Cards on UPI will provide a seamless, digitally enabled credit card lifecycle experience for the customers. Customers will benefit from the ease and the increased opportunity to use their credit cards. Merchants will benefit from the increase in consumption by being part of the credit ecosystem with acceptance of credit cards using asset lite QR codes.

RuPay Credit cards can now be linked to a UPI ID thus directly enabling safe, and secure payment

transactions.

Product features:

- Discover credit card accounts from the issuer bank based on your registered mobile number and

link it to the UPI ID on BHIM app or any UPI app.

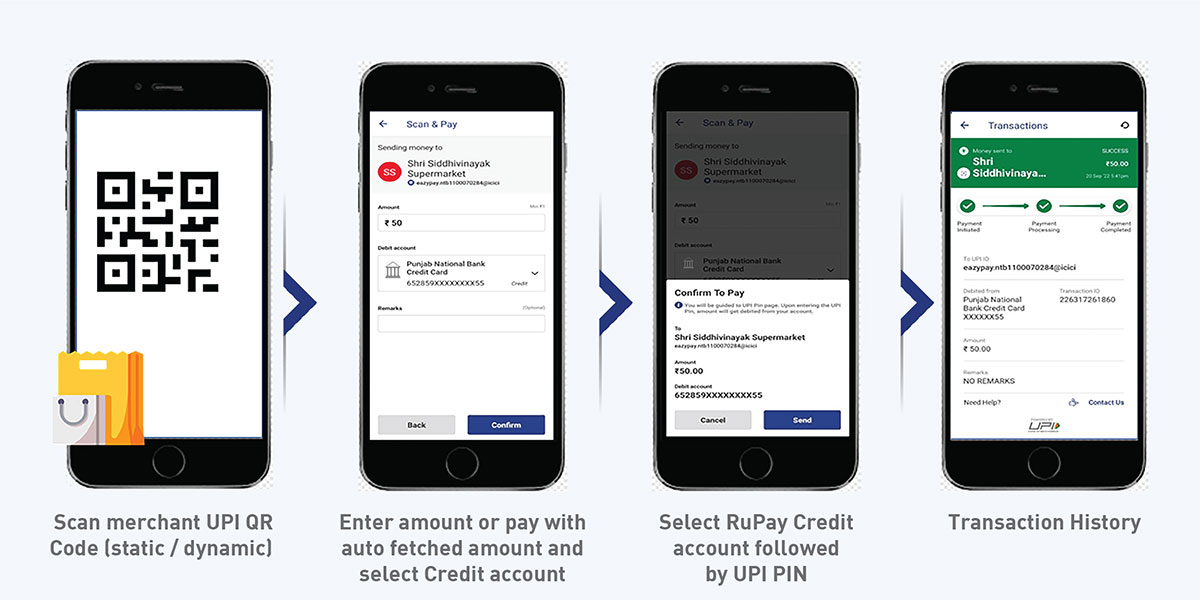

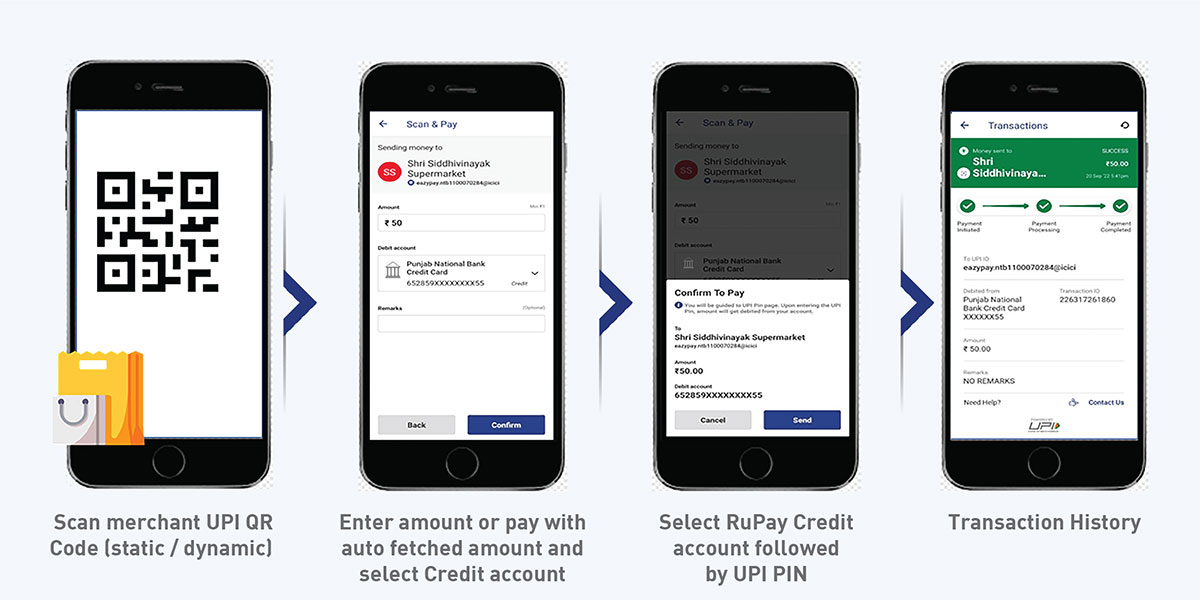

- Post linking the card, customer will be able to make payment to a merchant by scanning the UPI

QR code. Payment authentication will be done using UPI PIN.

- Cash withdrawal at merchant, P2P, P2PM, card to card payments will not be permitted through this

functionality.

- Features like AutoPay and dispute resolution will be available for the customer via ODR

(UPIHelp) through UPI Apps.

How to link RuPay Credit Card on UPI?

Make payment with RuPay Credit Card on UPI

Do’s

- Allow the UPI app to read your SMS, Contacts and Call history for the UPI app to

link your RuPay Credit Card.

- Always set up a different UPI PIN to authenticate Credit Card transactions on UPI,

at the time of linking your credit card on UPI.

- Make payment only to merchants QR Codes, e-comm merchant using CC on UPI.

- Setup UPI Autopay to make payments of your Credit Card bills on time.

- Always keep your mobile number updated with your Credit Card issuing bank, for you

to link your RuPay Credit Card on UPI.

- Do check your available balance and outstanding amount on UPI app before initiating

any merchant payment.

Don’ts

- Don’t share your UPI PIN with anyone.

- Don’t keep your CC on UPI PIN and your Saving Banks account UPI PIN & Card Pin same.

- Don’t share the OTP with anyone which you receive during the registration process.

- Don’t breach the credit limit assigned by your issuer on UPI while making payment to

merchants.

-

Don’t make payments using RuPay Credit Card on UPI for categories such as Person to

Person, digital account opening, lending platform, cash withdrawal at merchant, cash

withdrawal at ATM, Card to Card

payment, ERUPI, IPO, Foreign Inward Remittances, Mutual Funds, and any other

categories as restricted by the issuing bank / RBI from time to time.