Authors:

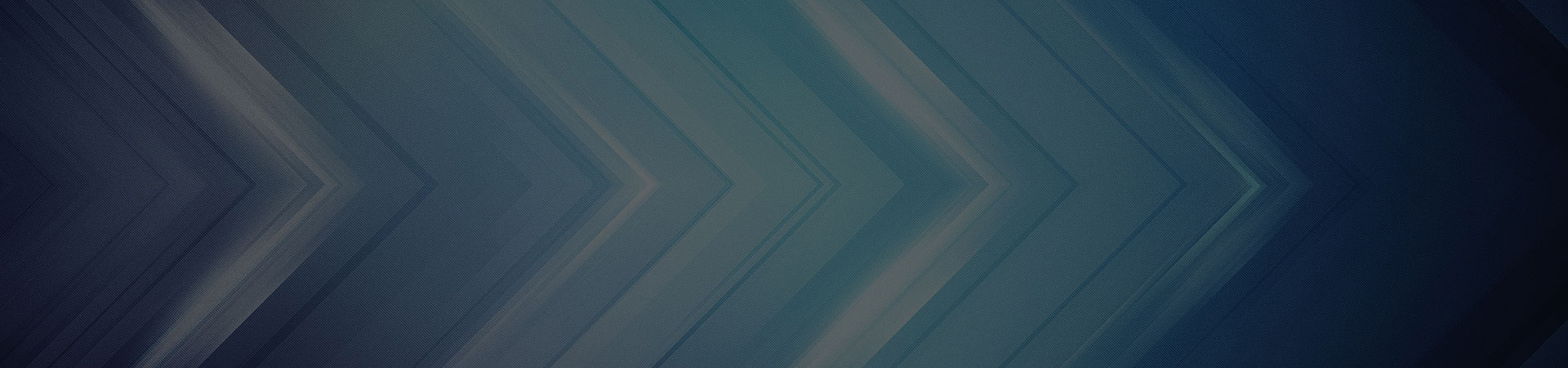

Digital payment infrastructure demands more than incremental improvements - it requires fundamental transformation that anticipates future needs while serving present demands, much like upgrading a city's transportation system while keeping traffic flowing smoothly. When construction begins, existing roads must remain operational as new highways and bridges take shape. The same principle guided NPCI's transformation journey - maintaining seamless payment services while building next-generation systems to serve India's digital future.

The challenge extended beyond establishing functional payment systems. India's digital infrastructure remained largely uncharted when we began our journey. Speed of deployment took precedence, leading to proprietary solutions that offered immediate reliability. However, like a rapidly growing city confined by old city walls, these closed systems soon revealed their limitations as transaction volumes exploded and innovation demands accelerated.

This technical evolution story traces the path from proprietary constraints to open-source innovation, highlighting how critical architecture decisions shaped the future of digital payments in India. The transformation required precision, scalability, and unwavering reliability - all while maintaining continuous service for millions of users who depended on these systems daily.

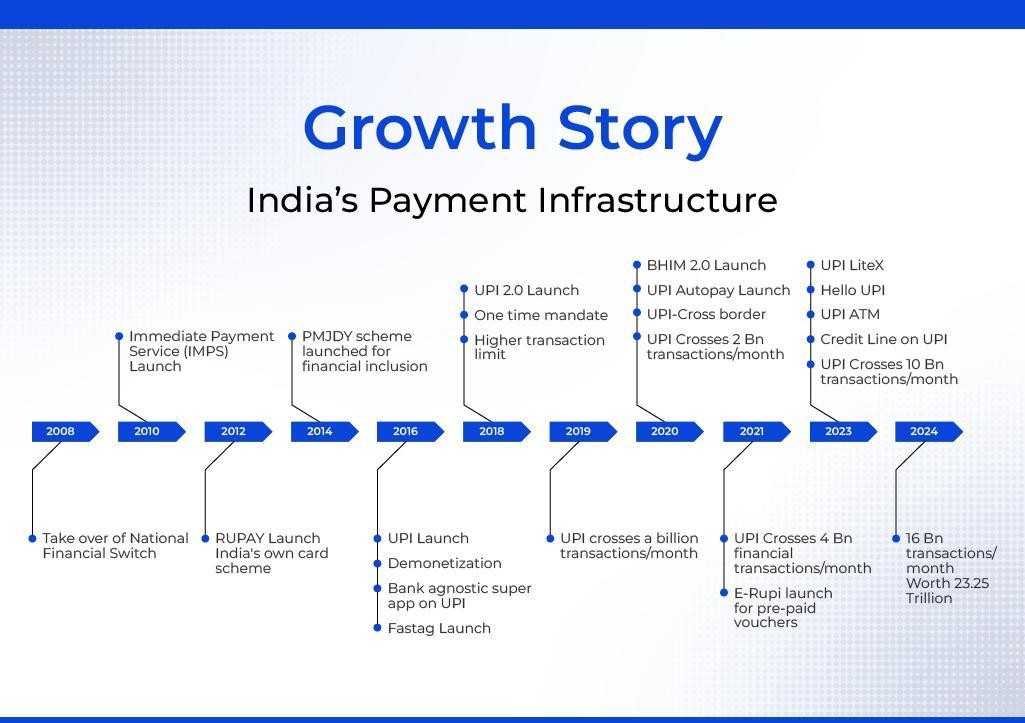

Our early days presented a clear imperative - establish reliable payment infrastructure quickly. We turned to proprietary solutions, implementing trusted, ready-made products that promised rapid deployment. While these systems provided our initial foundation, we soon discovered their inherent limitations as our operations scaled beyond original projections.

We found ourselves increasingly restricted by the closed nature of these systems. Each customisation required vendor involvement, while every upgrade followed the vendor's timeline rather than our market needs. What started as enablers of quick deployment transformed into bottlenecks for innovation and scale.

These constraints impacted more than technical capabilities - they affected our strategic decision-making and market responsiveness. The proprietary ecosystem dictated not just how our systems operated, but how quickly we could adapt to market changes. This created a ripple effect across our entire payment ecosystem, impacting banks, merchants, and end-users who relied on our infrastructure.

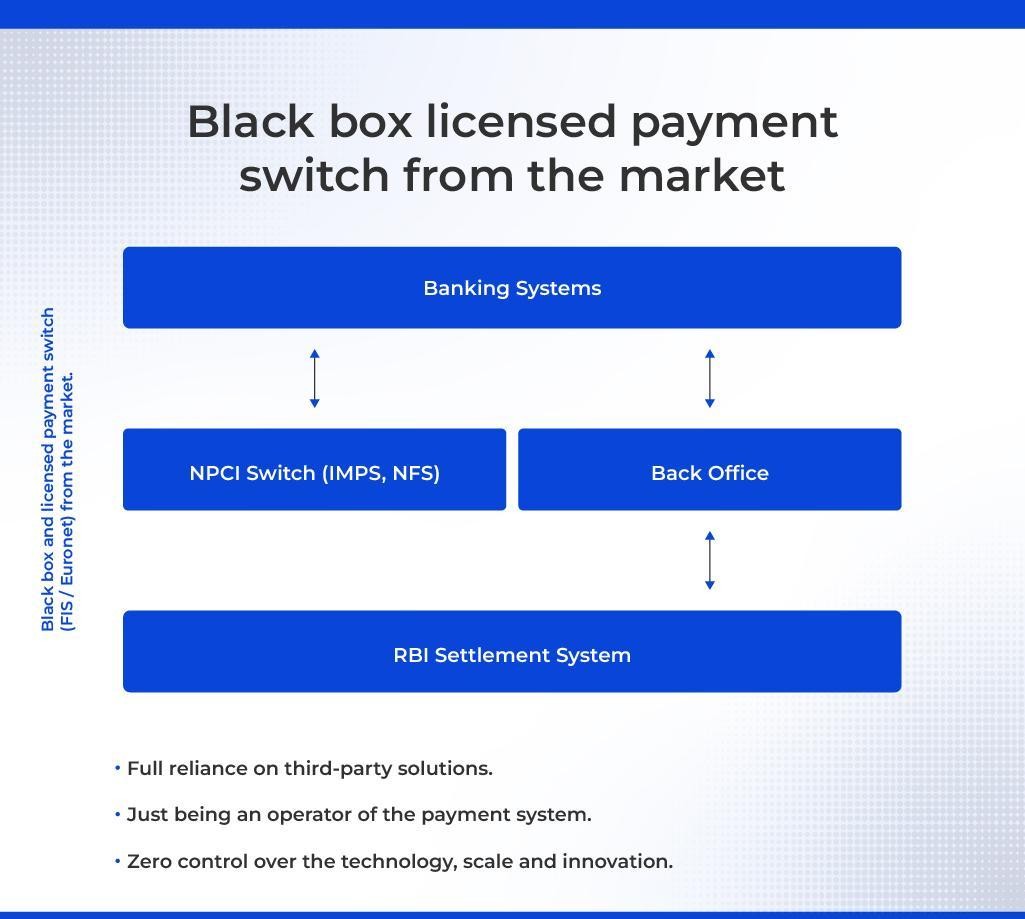

As we pushed forward, transaction volumes grew exponentially while our stakeholder network multiplied. The proprietary solutions that once served as enablers transformed into constraints. Our payment systems needed fundamental redesign rather than incremental updates to meet growing demands.

As our transaction volumes grew, integrating with multiple banks and third-party systems became more challenging. Implementing new features and services often required navigating extended vendor timelines, and customization options were not always available. The expenses associated with maintaining and scaling these proprietary systems increased, while our flexibility to adapt decreased. As market demands evolved rapidly, our capacity to respond was hampered by the limitations inherent in vendor-dependent solutions.

The financial implications extended beyond direct costs. Operating within proprietary constraints meant missed opportunities, delayed launches, and competitive disadvantages. Each passing quarter revealed a growing gap between market expectations and system capabilities, pushing us toward a critical decision point about infrastructure modernisation.

We discovered new possibilities through open-source technologies by looking beyond traditional boundaries. This shift represented more than cost savings - it marked a fundamental change in how we approached building and operating payment infrastructure. Open source offered us freedom from vendor lock-in and complete ownership of our technology stack.

Our initial concerns about scale and security gave way to confidence as we explored the open-source ecosystem. We adopted technologies like Redis for caching, PostgreSQL for databases, and Apache Kafka for real-time data streaming, discovering their enterprise-grade capabilities. The open-source community provided battle-tested solutions to our complex problems.

This transition marked a philosophical shift in our approach to technology infrastructure. Rather than viewing technology as a service to purchase, we transformed it into a capability to develop and nurture. This mindset transformation proved as valuable as the technical changes themselves, fostering a culture of innovation and ownership within our organisation.

Moving from proprietary systems to open source enabled us to build solutions precisely matched to our requirements. Our development of Unified Payments Interface (UPI) exemplified this approach - we designed it from the ground up using open-source tools to create a secure, scalable platform processing over 20,000 transactions per second.

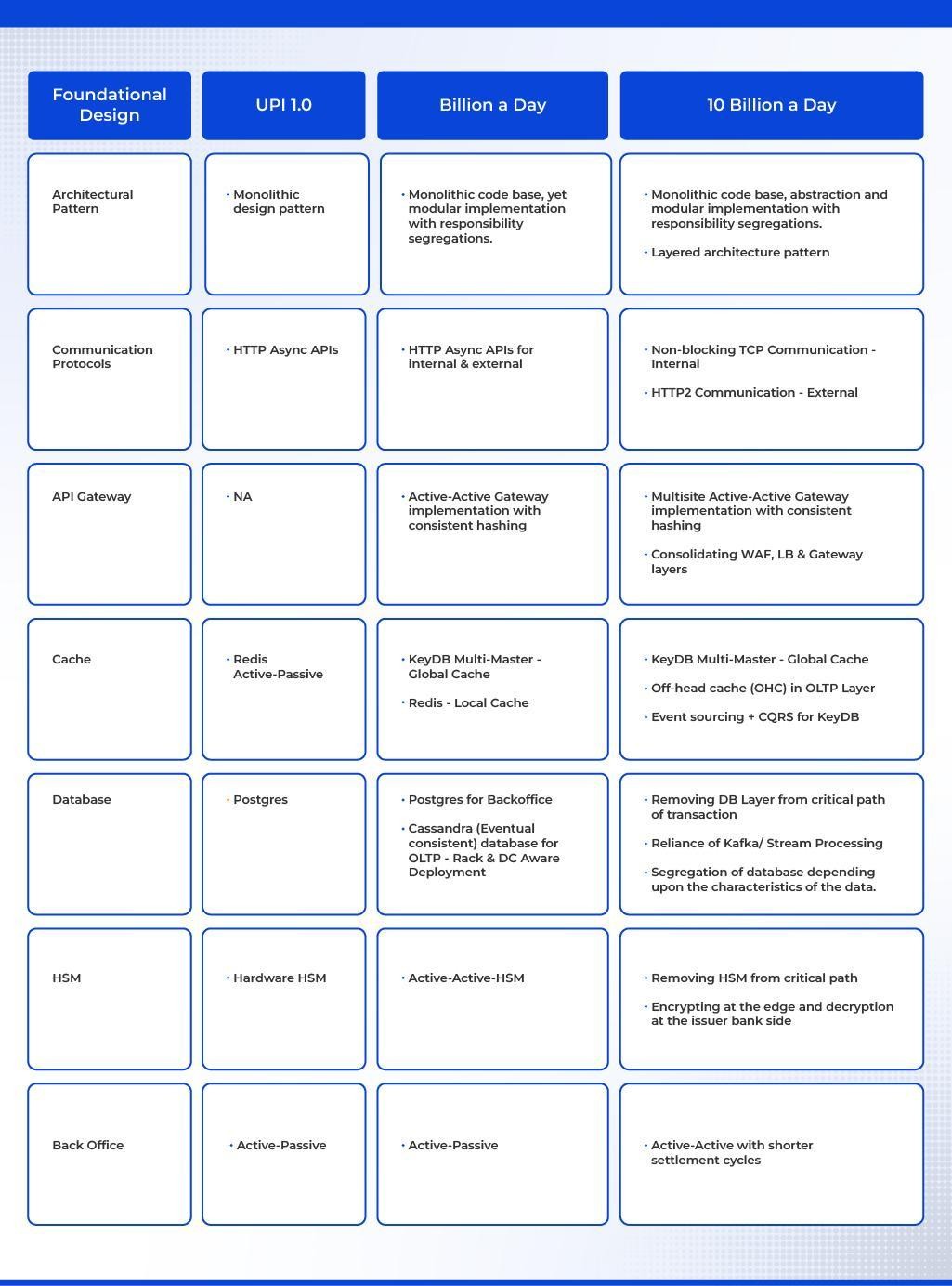

We implemented a modular, layered architecture that allowed us to break systems into independent components that could scale individually. This improved both efficiency and fault tolerance. The ability to modify and deploy without vendor constraints accelerated our innovation cycles dramatically.

The success of this architectural approach validated open source's viability for critical national infrastructure. Our performance metrics demonstrated not just parity with proprietary solutions, but significant improvements in transaction processing speed, system reliability, and scalability. The modular design proved particularly valuable during traffic spikes, allowing dynamic resource allocation based on real-time demands.

The payment infrastructure now handles thousands of transactions per second through a robust, distributed architecture. Apache Kafka powers real-time data streams enabling instant fraud detection. NoSQL databases like Cassandra manage massive distributed datasets required at national scale.

We've built our foundation on proven open-source technologies:

Our modular architecture supports independent scaling of components while maintaining system-wide reliability. This approach enables processing billions of transactions while preparing for future growth.

The evolution continues as emerging technologies present new opportunities. Machine learning models improve fraud detection accuracy while blockchain exploration opens possibilities for new payment paradigms. The open-source foundation provides flexibility to integrate these innovations without fundamental architecture changes, ensuring long-term sustainability of the payment infrastructure

The transformation from proprietary to open-source infrastructure represents more than technical evolution. NPCI has established a foundation for continuous innovation in digital payments that processes over 18.30 billion transactions monthly, worth Rs 24.77 Lakh Crores. As transaction volumes grow and new payment modes emerge, our open-source architecture provides the flexibility and control needed to build future payment systems.

Our journey from proprietary constraints to open-source freedom demonstrates the power of choosing the right foundation. We continue evolving our digital payment infrastructure, driven by technology choices that prioritise scalability, security, and innovation, serving as a blueprint for large-scale financial technology transformation.