Embarking on international travel? That’s the dream. However, ensuring access to funds and smooth financial transactions while abroad is essential for a stress-free journey. Activating your international card is a crucial step in this process, allowing you to use your card seamlessly across borders. Whether you're planning a leisurely vacation or a business trip, here are some key steps to activate your international card and make the most of your travels.

Step 1: You need to check the international eligibility of your card. Most often, it’ll be mentioned on the card facia or the back of the card.

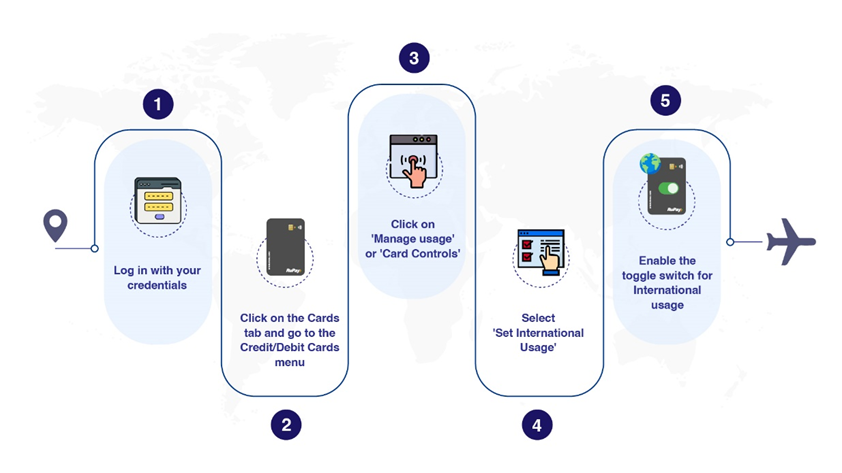

Step 2: You need to activate your international usage via the mobile banking app or net banking by following these simple steps.

If you wish to modify your daily international usage on the card:

You can also visit your nearest bank branch to activate this feature on your card.

Take note, cardholders: During setup, remember that contactless and online transactions for ecommerce purchases can usually be activated within the same tab or page. This convenient approach offers efficiency and empowers you to tailor your transaction preferences effectively.